About Cards

Overview of Infinity Cards

Interlace provides a flexible and robust card management system, enabling developers to create, issue, manage, and monitor both virtual and physical cards. With Interlace, you can customize cards to meet diverse payment needs while processing various transactions in real-time.

What is Infinity Card?

Infinity Card is one of the core features of the Interlace system, allowing developers to create virtual cards (for online transactions) and physical cards (for offline payments). With Infinity Card, developers can set spending limits, manage budgets, and enhance payment control and flexibility for their users.

Key Features

The Interlace card management system offers the following key functionalities:

- Create Virtual and Physical Cards: Create and manage multiple types of cards, assigning them to users as needed.

- Card Control and Management: Set spending limits, usage scopes, etc., for each card.

- Real-Time Fund Loading: Load funds onto cards in real time and perform balance inquiries.

- Transaction Monitoring: Monitor card transactions and ensure compliance for every transaction.

Card Types

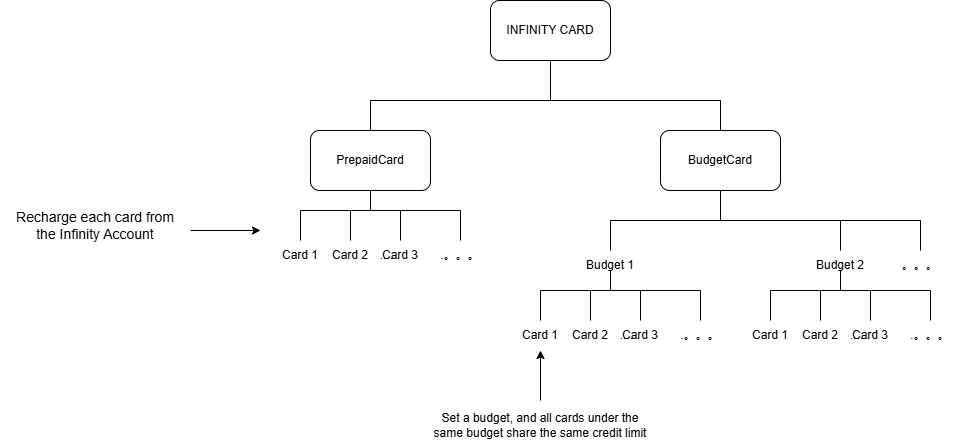

1 Prepaid Card and Budget Card

1.1 Prepaid Card

Infinity Prepaid Cards are directly funded by a Infinity Account. Users can only spend the amount loaded onto the card, with no budget constraints.

1.2 Budget Card

Infinity Budget Cards are subject to a shared budget. Multiple cards can be linked to the same budget, and once the budget is depleted, none of the associated cards can be used.

2 Virtual Card and Physical Card

2.1 Virtual Card

Virtual cards are fully digital, designed for online payments and other contactless scenarios. They allow you to generate unique card numbers for users and provide high flexibility for every transaction.

- Flexibility: Virtual cards enable highly customizable features, such as spending limits and usage scopes.

2.2 Physical Card

Physical cards are traditional cards designed for offline payments, such as in-store purchases or ATM withdrawals. They can be fully customized and support modern payment functionalities like NFC (Near-Field Communication).

- Traditional Cards: Physical cards offer the same level of flexibility as virtual cards while supporting additional offline payment scenarios.

- NFC Support: Physical cards are equipped with NFC for seamless and convenient payments.

2.3 Comparison of Virtual and Physical Cards

| Feature | Virtual Cards | Physical Cards |

|---|---|---|

| Form | Digital | Physical card |

| Primary Use | Online payments | Offline payments and ATM withdrawals |

| Custom Design | Applicable if Google Pay and Apple Pay are supported | Fully customizable |

| NFC Support | Applicable if Google Pay and Apple Pay are supported | Yes |

| Issuance Speed | Instant | Delivery time required |

Card Use Cases

Interlace cards are suitable for a wide range of payment scenarios, particularly in the following areas:

1. Advertising Expenses

Use cards to pay for advertising on platforms such as Facebook, Google, Pinterest, Instagram, Snapchat, and Twitter.

2. E-commerce Purchases

Make purchases on e-commerce platforms like Amazon, AliExpress, Wish, eBay, and Alibaba for activities such as personal shopping or bulk buying.

3. Online Payments

Pay for subscriptions (e.g., Shopify, App Store, Facebook), purchase applications or games, and cover travel expenses like airline tickets and hotel bookings.

API Overview

Interlace provides a variety of APIs to help developers manage and operate cards. Below are the primary API types:

1. Card APIs

- Create Card: Create virtual or physical cards through the API.

- Card Details: Retrieve detailed information about a particular card (e.g., card number, card status).

- Update Card: Adjust card restrictions, expiration dates, and more.

2. Budget APIs

- Fund Loading: Load funds onto cards via API.

- Balance Inquiry: Check the balance and funding status of cards.

3. Transaction APIs

- Transaction Records: Retrieve all transaction records for a card.

- Transaction Control: Ensure each transaction complies with preset rules and limits.

- Transaction Monitoring: Monitor the real-time status of card transactions.

Summary

Interlace's card management system offers developers highly customizable payment solutions. Whether for online payments, offline payments, or corporate expense management, Interlace makes it easy to implement your requirements. With our APIs, you can create, manage, and monitor each card in real time, ensuring every transaction aligns with your budget and control policies.

Updated about 2 months ago